What is sparkle business?

Everything you need for your business at the tip of your fingers

Sparkle Business helps small and medium enterprises manage their business in the most simplest and efficient way possible.

The only business account that requires zero documentation for opening an account, aids in tax remittance and inventory management, all done on your mobile phone.

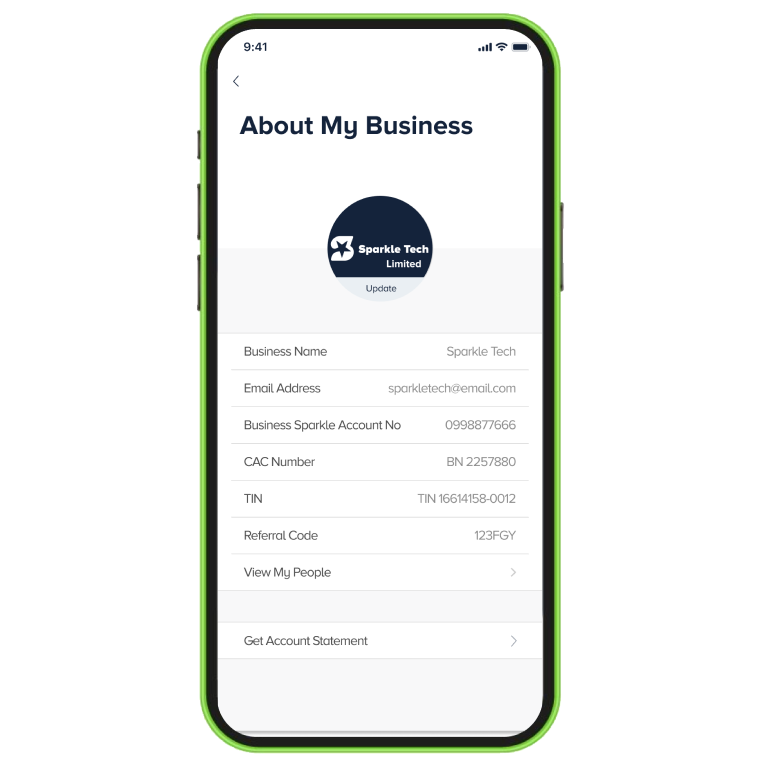

Business Account Opening

Open a Sparkle Business Account with no documentation

Sparkle Business Account was made for Sparkle personal account owners who have a TIN (Tax Identification Number) and looking for a simple, transparent and trustworthy account so they can improve their business significantly.

We also have a business support platform that not only helps but also gives you the opportunity to do the following:

- Register your new business & company name.

- Apply for a new tax identification number

- Edit your tax identification number info.

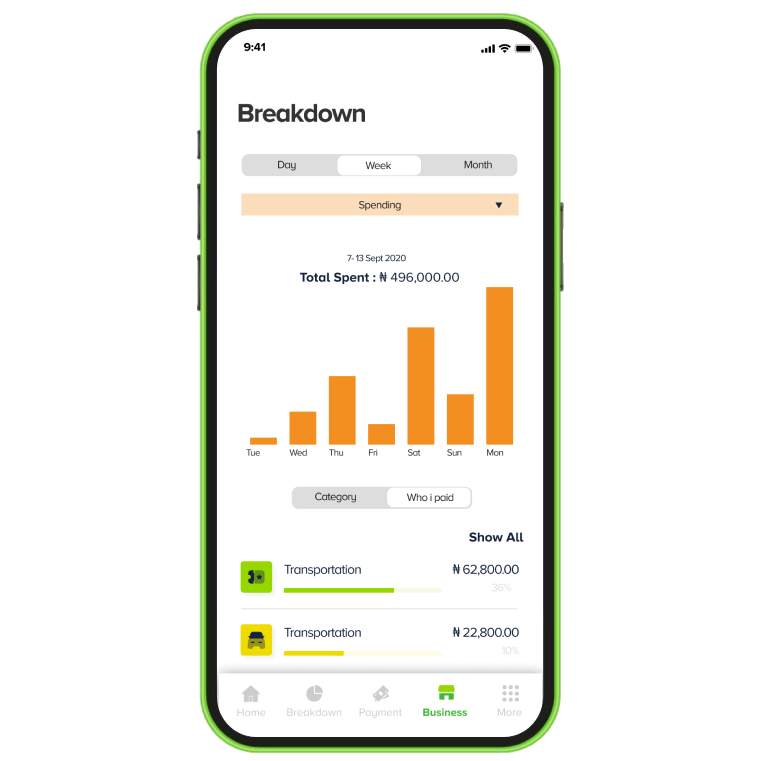

Business insight and productivity

Revenue, Customers, Sales and Expenses

Monitor your business activities by managing your products and customers, all from your device. Identify top selling products and customers with the highest patronage. Improve your revenue as well as manage your business expenses.

With Sparkle business you can improve your business productivity by keeping track and managing your business metrics, all on the go.

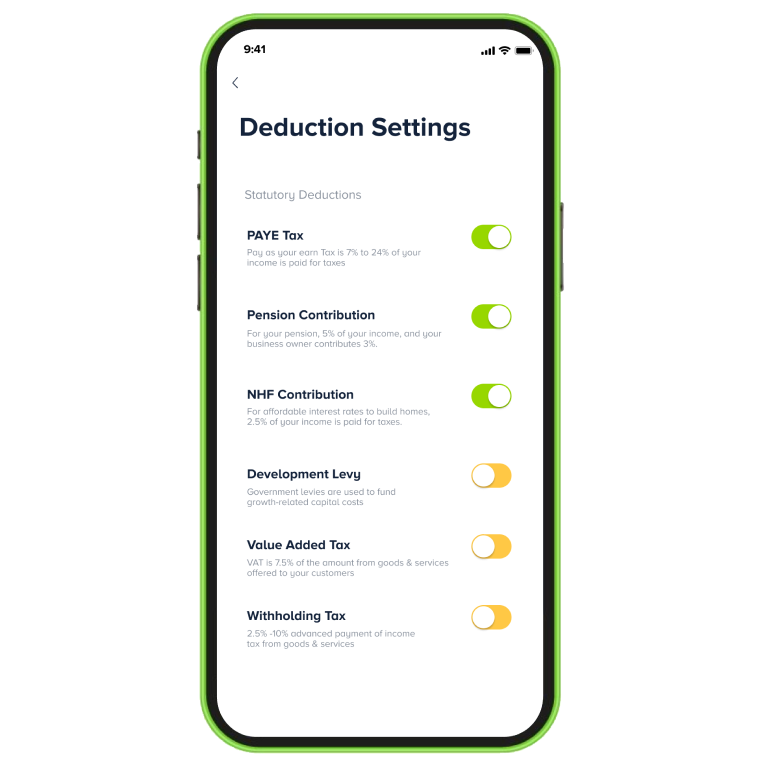

Taxation & Payroll

Employee Management, Payroll, Tax Remittance

With our easy to use mobile application you can manage your workers and employees payroll and salaries payment to sparkle and various other bank accounts.

A sub-account is made available for you on your sparkle business that houses all your tax deductions and returns giving your timely update for remittance and tax payments.

InVENTORY & INVOICE

Business accounting, store keeping & payment request

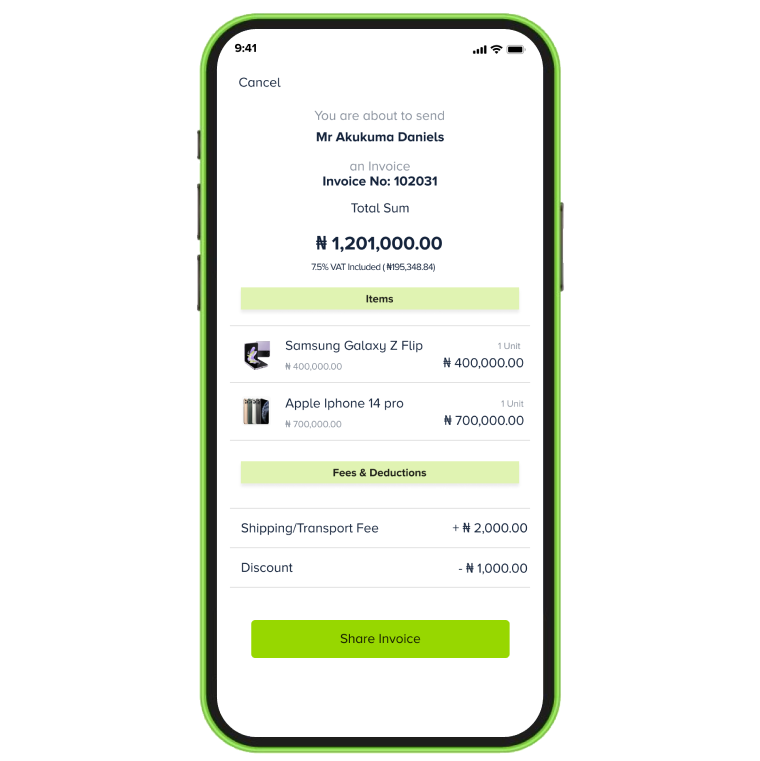

Sparkle business integrates accounting tools as you get visibility and more control of your business products with inventory management and sparkle smart invoice.

You can manage your product store count as well as send invoices to customers with our smart invoice that aids in discount making and VAT analysis.

Frequently Asked Questions

FAQs

It’s easy! First, download the Sparkle app from App Store or Play Store. Then, create your own personal account. Once you’re done with that, tap the home button and click on “Get Sparkle Business” to create your business account. The get “Sparkle Business” button is just right next to the “Show Balance Button”.

Yes, you do! Before you dive into Sparkle Business, you need to have your very own Sparkle personal account.

Your business account gets added to your personal one. And guess what? Switching between them is super simple! On your personal account dashboard, just tap on “Switch Account”. It’s right next to the “Show Balance” button.

You only need your CAC certificate and your TIN. If we need any other information, we’ll just get it from your personal account.

You don’t need to open your Sparkle Business account with any amount of money. We keep things sparkling over here!

After opening your account, you can fund it with as much money as you wish!

On your business account, we charge for similar things as your personal account. Transferring money, paying bills, and a monthly fee for the SMS notifications we send to you. The good news is, we don’t charge you for using all the cool business features we have!

Piece of cake! On the Sparkle app, just click on the “Switch Account” button which is right next to the “Show Balance” button. That’s it!

Sure thing! When customers want to make payment to your business account, they’ll see your registered business name. This way, they'll know they're sending money to the right place.

Absolutely! You can get up 5 physical cards and they’re like little helpers for your business. You get to assign them to different members of your team for different business expenses like subscriptions, and more.

Hmm, we know what you’re thinking but no worries, you’re still in control. You get to set spend limits to control how much your team spends, and if a card goes missing or a team member doesn’t work for you anymore, you can easily block the card in a snap.

Only the Boss (that’s you) can have access to your Sparkle Business account but you can create and assign cards to your team members so they can handle some business expenses. The cards are connected to your business account, and you have full control of them.

📦 Mange Your Inventory: Our superstar Inventory tool helps you manage all the products you have in stock from the comfort of your mobile phone. You get to know your best-selling products and more.

💼 Create Invoices: No more paperwork mess! You can create pro invoices on your phone and share them with your customers in minutes.

💰 Make and Receive Payments: Get paid in all the cool ways – transfer, QR, Nearby Pay, SparklePay, Request Money and more. Our sparkling payment options make it easy for you to pay and get paid!

📊 Mange Your Taxes: Taxes made simple? You bet! Our special tax tool helps with your tax calculations and deductions, so you can pay your taxes without breaking a sweat.

💼 Manage Your People: With the “My People” feature, you can handle your team's payments right from the app! It's like having your own payroll assistant.

👭 Manage Your Customers: With the ‘My Customers’ feature, you get to know your loyal customers so you can create sparkling deals and offers for them.

So, you see, Sparkle Business isn't just an account – it's a whole bundle of magic for your business.